General Questions

Who is INTERBOLSA?

INTERBOLSA – Sociedade Gestora de Sistemas de Liquidação e de Sistemas Centralizados de Valores Mobiliários, S.A. (hereinafter referred to as INTERBOLSA) has as its object the management of settlement systems and centralised securities systems.

The share capital of INTERBOLSA is five million and five hundred thousand Euros, represented by five million and five hundred thousand registered book-entry shares, with the nominal value of one Euro each, being EURONEXT LISBON – Sociedade Gestora de Mercados Regulados, SA (hereinafter referred to as EURONEXT LISBON) as the sole shareholder of INTERBOLSA.

The following international codes were assigned to INTERBOLSA:

- Bank Identifier Code (BIC): IBLSPTPPXXX

- Legal Entity Identifier (LEI) code: 529900LG70TCAGWCXT47 – LEI Code

- International Securities Identification Number (ISIN) code: PTIBO0AM0007 – site, menu “Others Services / National Numbering Agency“

What is the legal regime of INTERBOLSA ?

INTERBOLSA is governed by the provisions of the respective Statutes, Decree-Law No. 35/2018, of July 20, in Regulation (EU) No. 909/2014, of July 23 (in short, CSDR), in the Corporate Code and the Portuguese Securities Code.

What is a CSD ?

A CSD – “Central Securities Depositories” (“Central Securities Depository”), is an entity that provides securities registration and maintenance services, as well as their settlement.

A CSD shall be authorized by the national competent authority of its home Member State and regularly supervised by that body.

While CSDs may have different business models, the definition introduced by Regulation (EU) No. 909/2014 of 23 July (CSDR) defines CSDs by reference to certain core services :

CSDs should manage at least one securities settlement system and provide another core service. This combination is essential for CSDs to play their role in the settlement of securities and to ensure also the integrity of securities issues.

The usual clients of a CSD are the Financial Intermediaries as custodian entities, but they can also be Issuers and other market infrastructures.

In the Portuguese market an individual investor cannot be a CSD client.

How important is a CSD?

The CSDs have systemic importance in the correct functioning of securities markets and are essential tools for controlling their issuances, since they contribute to their integrity (preventing the creation or undue reduction of amounts already issued), thus playing a key role in maintaining investor confidence.

In addition, CSDs allow risk to be reduced in operations transactions between buyers and sellers as they offer the possibility of DVP settlement – delivery versus payment.

What are the functions of INTERBOLSA as a CSD?

As CSD, INTERBOLSA is responsible for organizing and managing the following services :

Main Services:

Auxiliary Services:

- Acting as National Numbering Agency;

- Organization and structuring of a Securities Lending Service;

- Organization and structuring of an Investment Fund Service – Order Routing Service;

- Identification Holders Service;

- Corporate Action Notification Service;

- Links with other CSDs;

- Statiscal information.

For more information consult website, “Services” menu.

What are the costs associated with INTERBOLSA’s activity ?

The commissions owed to INTEBROLSA by its Clients (Financial Intermediaries, Issuers and Other Entities) are under the heading “Fee Book“, menu “Information and Documentation” .

Who are the INTERBOLSA Participants?

INTERBOLSA develops and provides, namely, custody and settlement services to Financial Intermediaries or other entities affiliated to the systems it manages, as well as to Issuers with securities registered at centralised systems and other entities with which it is connected.

In the context of the management by INTERBOLSA of the securities settlement systems and the participation of this management entity in the TARGET2-Securities platform (T2S platform), the Participants in the settlement systems managed by INTERBOLSA may assume the following qualities as regards connection to the T2S platform:

Both qualities are subject to the supervisory and control powers provided for in the INTERBOLSA Regulation No. 1/2016 – Participants in the systems managed by INTERBOLSA

Additional information available in “Customers” menu, submenu “Our customers“.

How to access to the quality of the INTERBOLSA affiliate?

The quality of affiliated shall be requested by the interested parties by a requisition addressed to the Managing Board of INTERBOLSA and should indicate the kind of participation desired as well as the systems and services they intend to make use of, namely the direct orindirect connection to the T2S platform and demonstrate compliance with the requirements of Regulation No. 1/2016 of Interbolsa – Participants in the systems managed by INTERBOLSA .

Financial Intermediaries (or other entities that comply with the requirements required by the law and the regulations in force) can access the Membership status.

Members of the Systems managed by INTERBOLSA may be:

Access requirements:

- To have the technical and operational conditions, as well as human resources, determined by INTERBOLSA;

- To conclude an Affiliation Contract and pay the membership fee;

- To be registered, if applicable, in the Securities Market Commission or to have obtained the necessary and appropriate recognition to operate in Portugal;

- Indicate an open money account on the TARGET2 platform (RTGS Account) and one or more cash accounts opened on the TARGET2-Securities (Dedicated Cash Accounts-DCAs).

For the purposes of filing an application for membership, INTERBOLSA provides the requesting entities with a detailed dossier containing the various documents and information that must be filled out and provided, so that the membership can take place.

For more information, consult INTERBOLSA Regulation nº 1/2016 – Participants in the systems managed by INTERBOLSA.

What are the operating hours of the systems managed by INTERBOLSA and its schedule of operation?

The working calendar of INTERBOLSA is based on the schedule defined for the TARGET2 (Trans-European Automated Real Time Gross Settlement Express Transfer System). On May 1 (Labor Day), INTERBOLSA’s systems are open for the settlement of instructions free of payment, according to the schedule of T2S – TARGET2-Securities.

The operating hours of the Centralised Systems and Settlement Systems managed by INTERBOLSA are based on the operating hours of the T2S – TARGET2-Securities platform.

Additional information can be found on INTERBOLSA Menu, about the availability dates/times of the services: “Timetable and opening hours”

How can I contact INTERBOLSA?

Specific Questions

What are the advantages of register in the systems managed by INTERBOLSA?

INTERBOLSA is a strategic infrastructure with wide market experience, subject to specific regulation, which offers a secure, reliable registration and custody system that guarantees confidentiality, efficiently and at a reduced cost.

All securities must be registered at INTERBOLSA?

Securities admitted to trading on a regulated market (depending on whether they are registered or represented in certificate form) must be registered or deposited with the Central Securities Depository.

The registration also takes place, officially, in the case of issues of securities resulting from the exercise of the rights inherent to securities that are part of the issuances already registered and of outstanding rights of securities integrated in a centralised system.

For all other cases, the registration of securities is voluntary.

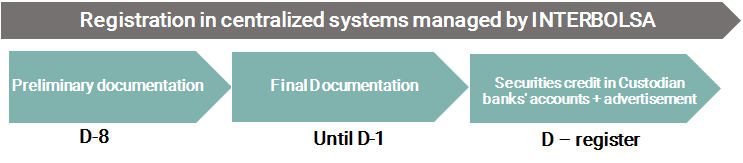

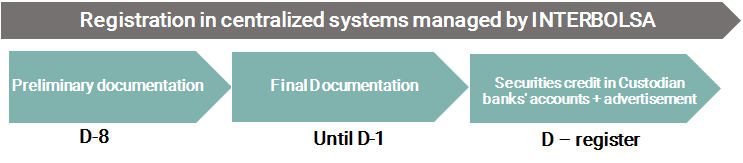

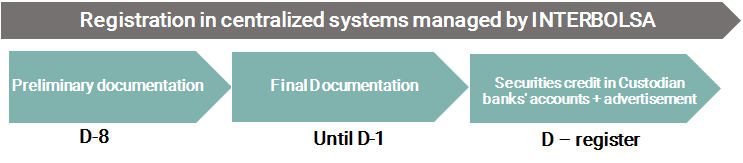

What is required to registered a securities issue at INTERBOLSA?

The registration of securities in a centralised system is requested to INTERBOLSA by the Issuer or by any other entity duly authorized for this purpose.

The process for the registration of issues must be accompanied by the documentation that identifies the Issuer and the securities to be registered.

For more information see INTERBOLSA Regulation No. 2/2016 – General operational rules for the operation of centralized securities systems and settlement systems managed by INTERBOLSA – Article 18.

REGISTRATION PROCEDURE – SHARES

| Identification of the Issuer: |

| – Legal Entity Identifier (LEI) – By-laws – Certificate of Commercial Registration |

| Issue identification: |

| – Form and representation of the securities and, if any, their nominal value – Information about any special rights and obligations or privileges of the categories of securities – Statement of mandate (if applicable) – Instruction of the registration of shares in the accounts of the Custodian Banks |

| Other Information: |

| – Indication of the method of processing the payment of commissions to INTERBOLSA – If securities issued in certificate form – copy of a certificate + information about lost |

REGISTRATION PROCEDURE – INVESTMENT FUNDS

| Identification of the Management Entity: |

| – Legal Entity Identifier (LEI) – By-laws – Certificate of Commercial Registration of the Management Company |

| Issue identification: |

| – Fund Management Regulations – Proof of registration of the fund at the CMVM – Identification of the depositary bank – Statement of mandate (if applicable) – Instructions for registration of units in the Custodian Banks’ accounts |

| Other Information: |

| – Indication of the method of processing the payment of commissions to INTERBOLSA – If securities issued in certificate form – copy of a certificate + information about lost |

REGISTRATION PROCEDURE – DEBIT

| Identification of the Issuer: |

| – Legal Entity Identifier (LEI) – By-laws – Certificate of Commercial Registration |

| Issue identification: |

| – Prospect – Termsheet – Authenticated copy of the minutes that approved the issue – Statement of mandate (if applicable) – Bond placement instruction (with authorization of disclosure of data from the holder to the FI to be credited by the securities). |

| Supporting documentation: |

| – Proof of registration at the Registry and Opinion of the Supervisory Board – Audited company accounts (if constituted less than one year ago) – Additional documentation (contracts, etc.) |

| Other Information: |

| – Indication of the method of processing the payment of commissions to INTERBOLSA – If securities issued in certificate form – copy of a certificate + information about lost |

There is a limit number of accounts to be opened on systems managed by INTERBOLSA ?

Each Financial Intermediary must request INTERBOLSA to open securities accounts, as many as are necessary for the execution of its activity, and also to protect the segregation needs.

What is account segregation?

INTERBOLSA keep records and accounts that allow, in accordance with Article 38 of the CSDR (Protection of securities of participants and their customers) to Participants in the management body systems, segregate their securities ( ‘own’ – “W”) of securities of its clients (mandatory segregation) and voluntarily:

For its part, INTERBOLSA Participants must also give to its customers the possibility to choose between full segregation of customers and individual client segregation and inform them of the costs and risks associated with each option.

In order for INTERBOLSA to be able to comply with its reporting obligations within CSDR, in opening a securities account, in addition to other necessary information, the Participant has to inform if it is a:

- Own account – “OW”; or

- Clients Omnibus Account – “OM”; or

- Client Individual Account – “IS.

How to open, change, or delete a securities account?

Participants must fill out a specific form depending what the purpose:

The form must be requested and sent to INTERBOLSA, through the e-mail address: T2S_forms@interbolsa.pt.

The assignment of an ISIN code is mandatory ?

The assignment of the ISIN code is mandatory for securities registered in a centralised system .

Securities and deferred rights are identified in the accounts by the ISIN code. (Article 34 of CMVM Regulation No. 14/2000 – only in Portuguese) .

The ISIN code is also mandatory for securities traded on Regulated Market or Alternative Trading Platform (MTF) and required by other regulations of the European Union financial markets, namely:

ISIN code assignment requests should be sent to the e-mail address isin@interbolsa.pt.

What is the importance of the ISIN codification?

The ISIN code allows unambiguous and harmonized identification of all securities / financial instruments.

The creation of an internationally applicable identification system in order to facilitate and support the International Securities Market was the main objective of the creation of the ISO 6166 standard, which lays down rules on the ISIN code.

These codes, essential for the proper functioning of securities markets, allow an unambiguous recognition of securities and financial instruments, facilitating the exchange of information between the Participants of the capital market.

The ISIN codes are, from the moment they are assigned, part of a global computer network, which allows access to international information on the ISIN codes assigned by the National Numbering Agencies around the world.

This tecnical platform is maintained by ANNA -Association of National Numbering Agencies. For further information see menu “INTERBOLSA” submenu “International Cooperation” .

Where you can ask for the issue of a LEI Code?

The LEI codes can be requested from any entity duly accredited by GLEIF – Global Legal Entity Identifier Foundation, established in 2014 to support the implementation and use of the LEI Code.

Entities issuing the LEI Codes are designated by LOU – Local Operating Unit and, before starting their activity, have to conclude with GLEIF a specific contract, through which the quality, reliability and usability of LEI Codes.

On March 27, 2018, the Euronext Group (of which INTERBOLSA is part) concluded the acquisition of the Irish Stock Exchange (ISE). ISE has joined the Euronext business model currently operating under the trade name Euronext Dublin.

Euronext Dublin is a duly accredited by GLEIF entity – LOU entity – for what is properly qualified to provide the codes issuing service LAW to Portuguese Issuers Entities .

For further information, refer to: LEI Code.