Risk Management

Euronext Securities Porto dedicates a rigorous and permanent attention to the maintenance of a prudent risk profile, balanced and adequate to the experience and capacity of the organization, preserving the basic objectives of solvency, profitability and adequate liquidity.

Euronext Securities Porto embeds the risk management philosophy into the Company culture, in order to make risk and opportunity management a regular and everyday process for its employees.

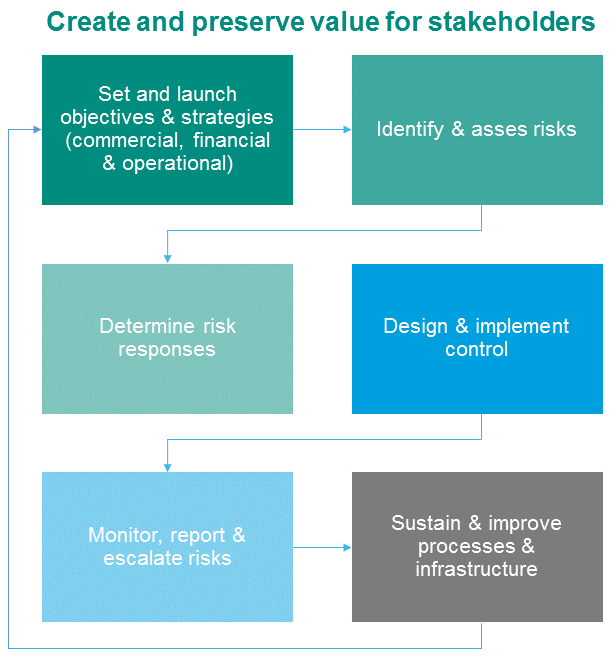

Euronext Securities Porto Managing Board regards the Risk Framework as a key management process, allowing management to effectively deal with risks and opportunities, in compliance with related laws and regulations.

Euronext Securities Porto promotes the adequate monitoring and evaluation of identified risks.

Euronext Securities Porto, as a Centralised Securities Systems and Securities Settlement Systems management entity, has a risk and internal control system which purpose is to monitor the risks inherent to its activity, minimize contingencies, adapt to changes in the economic and competitive environment and market changes, as well as, a more effective development and growth of the company.

In order to mitigate the risks inherent to the systems it manages and, consequently, to its business, Euronext Securities Porto has in place rules, contained in regulations, circulars and notices, which describe the procedures governing the Centralised Securities Systems and the Securities Settlement Systems.

Euronext Securities Porto has implemented a Business Continuity Plan (BCP) that aims to guarantee the permanent operation of its services and systems with the highest level of security, reliability and availability.

The Business Continuity Plan is tested annually, both internally and with different market players.

Euronext Securities Porto ‘s Business Continuity Plan (BCP) has been prepared in accordance with the international recommendations and best practices of business continuity in view of an integrated set of policies and procedures aimed at ensuring the continuous operation of its activity or its recovery in the case of an events that may lead to the unavailability of physical infrastructures, computer systems or human resources.

Business Continuity is vital to protecting and sustaining Euronext Securities Porto’s reputation, efficiency, resilience and competitiveness.

Euronext Securities Porto has implemented mechanisms to verify the adequacy and good functioning of the procedures and resources described in its Business Continuity Plan.

The BCP prepared by Euronext Securities Porto guarantees, not only the mitigation of the risk associated with the unavailability of the services it provides, but also reinforces the security and solidity of market structures, as well as the consolidation of the trust of investors and Participants, benefiting the Portuguese financial system as a whole.

Business Continuity Plan Test (October 7, 2023)

On the 7th of October 2023, Euronext Securities Porto carried out a global external test of business continuity with the activation of its disaster recovery center, allowing financial intermediaries to verify Euronext Securities Porto’s recovery capacity, acting normally from their own offices. This test is part of the plan for the verification of the adequacy and of the operation of the recovery procedures and necessary resources as described in the Business Continuity Plan of Euronext Securities Porto.

This test is part of the plan for the verification of the adequacy and of the operation of the recovery procedures and necessary resources as described in the Business Continuity Plan of Euronext Securities Porto.

Euronext Securities Porto took advantage of the availability of the T2S platform during a non-working day to test with external participation the activation of the Business Continuity Plan. This availability was made possible by ECB extending the real time settlement window after the NTS settlement on the night from Friday to Saturday until Saturday afternoon

The test was open to the voluntary participation of all financial intermediaries affiliated to Euronext Securities Porto, and ten institutions participated in this test of the disaster recovery center by accessing from their own offices, namely Banco Comercial Português, S.A, Banco Finantia, S.A., BNP Paribas, S.A., Citibank International, PLC, Caixa Geral de Depósitos, S.A., Novo Banco, S.A., Best – Banco Electrónico de Serviço Total, S.A., Novo Banco dos Açores, S.A., ABanca Corporation Bancaria, S.A. – Sucursal em Portugal and Banco de Portugal (DMR).

The test began on Saturday morning with a simulated incident, which left its main data center unavailable, with the consequent activation of the disaster recovery center and the re-routing of the communications decided after a meeting of the Crisis Management Team, thus allowing all participants to access the recovery system.

Immediately after the activation of the disaster recovery center, the Support and Recovery Teams activated the applications in the disaster recovery site and proceeded with the verification of the existence of information that resulted from the previous processing, as well as the accessibility to the services. After this the services were made available to the participants that they carried out testing activities using their terminals in their offices. These activities consisted of queries and data entry operations as well as information upload and download using the file transfer functions and real time messages of the STD system.

During the tests no critical issues were identified that could jeopardize the functioning of Euronext Securities Porto’s backup systems in a real disaster situation. This asserts the adequacy of the Business Continuity Plan of Euronext Securities Porto, as well as, of the disaster recovery data center.

All the activities executed according to a predefined test plan, which was thoroughly carried out. The testing was concluded with success, which was recognized by all internal and external participants.

Business Continuity Plan Test (October 22, 2022)

On the 22nd of October 2022, Euronext Securities Porto carried out a global external test of business continuity with the activation of its disaster recovery center, allowing financial intermediaries to verify Euronext Securities Porto’s recovery capacity, acting normally from their own offices. This test is part of the plan for the verification of the adequacy and of the operation of the recovery procedures and necessary resources as described in the Business Continuity Plan of Euronext Securities Porto.

This test is part of the plan for the verification of the adequacy and of the operation of the recovery procedures and necessary resources as described in the Business Continuity Plan of Euronext Securities Porto.

Euronext Securities Porto took advantage of the availability of the T2S platform during a non-working day to test with external participation the activation of the Business Continuity Plan. This availability was made possible by ECB extending the real time settlement window after the NTS settlement on the night from Friday to Saturday until Saturday afternoon.

The test was open to the voluntary participation of all financial intermediaries affiliated to Euronext Securities Porto, and eight institutions participated in this test of the disaster recovery center by accessing from their own offices, namely Banco Comercial Português, S.A, Banco Santander Totta, S.A., Banco Finantia, S.A., BNP Paribas Securities Services, S.A., Citibank International, PLC, Caixa Geral de Depósitos, S.A., Caixa Banco de Investimento, S.A and Banco de Portugal (DMR).

The test began on Saturday morning with a simulated incident, which left its main data center unavailable, with the consequent activation of the disaster recovery center and the re-routing of the communications decided after a meeting of the Crisis Management Team, thus allowing all participants to access the recovery system.

Immediately after the activation of the disaster recovery center, the Support and Recovery Teams activated the applications in the disaster recovery site and proceeded with the verification of the existence of information that resulted from the previous processing, as well as the accessibility to the services. After this the services were made available to the participants that they carried out testing activities using their terminals in their offices. These activities consisted of queries and data entry operations as well as information upload and download using the file transfer functions and real time messages of the STD system.

During the tests no critical issues were identified that could jeopardize the functioning of Euronext Securities Porto’s backup systems in a real disaster situation. This asserts the adequacy of the Business Continuity Plan of Euronext Securities Porto, as well as, of the disaster recovery data center.

All the activities executed according to a predefined test plan, which was thoroughly carried out. The testing was concluded with success, which was recognized by all internal and external participants.

Business Continuity Plan Test (October 30, 2021)

Euronext Securities Porto has in place a process for constant maintenance of its Business Continuity Plan, according to the best international practices, in order to ensure that the strategy and the procedures defined within the plan are capable to address any foreseeable crisis situation allowing, thus, the good functioning of the Market.

On the 30th of October 2021, Euronext Securities Porto carried out a global external test of business continuity with the activation of its disaster recovery center, allowing financial intermediaries to verify Interbolsa’s recovery capacity, acting normally from their own offices. This test is part of the plan for the verification of the adequacy and of the operation of the recovery procedures and necessary resources as described in the Business Continuity Plan of Euronext Securities Porto.

Euronext Securities Porto took advantage of the availability of the T2S platform during a non-working day to test with external participation the activation of the Business Continuity Plan. This availability was made possible by ECB extending the real time settlement window after the NTS settlement on the night from Friday to Saturday until Saturday afternoon.

The test was open to the voluntary participation of all financial intermediaries affiliated to Euronext Securities Porto, and ten institutions participated in this test of the disaster recovery center by accessing from their own offices, namely Banco Comercial Português, S.A., Novo Banco, S.A., Novo Banco Açores, S.A., BEST – Banco Electrónico de Serviço Total, S.A, Banco Finantia, S.A., BNP Paribas Securities Services, S.A., Citibank International, PLC – Sucursal em Portugal, S.A., Caixa Geral de Depósitos, S.A., ABANCA Corporacion Bancária, S.A. – Sucursal em Portugal and Banco de Portugal (DMR).

The test began on Saturday morning with a simulated incident, which left its main data center unavailable, with the consequent activation of the disaster recovery center and the re-routing of the communications decided after a meeting of the Crisis Management Team, thus allowing all participants to access the recovery system.

Immediately after the activation of the disaster recovery center, the Support and Recovery Teams activated the applications in the disaster recovery site and proceeded with the verification of the existence of information that resulted from the previous processing, as well as the accessibility to the services. After this the services were made available to the participants that they carried out testing activities using their terminals in their offices. These activities consisted of queries and data entry operations as well as information upload and download using the file transfer functions and real time messages of the STD system.

During the tests no critical issues were identified that could jeopardize the functioning of Euronext Securities Porto’s backup systems in a real disaster situation. This asserts the adequacy of the Business Continuity Plan of Interbolsa, as well as, of the disaster recovery data center.

All the activities executed according to a predefined test plan, which was thoroughly carried out. The testing was concluded with success, which was recognized by all internal and external participants.

Euronext Securities Porto’s Response to the Association of Global Custodians (AGC) Questionnaire: