The Settlement Discipline regime is a key requirement of the CSD Regulation (CSDR) which purpose is to promote the operational efficiency of CSDs and thereby contribute to a timely and efficient settlement within the EU.

Under this regime, INTERBOLSA has been:

- Introducing a set of rules and procedures in order to encourage the settlement of transactions on the intended settlement date;

- Adopting a range of measures to prevent settlement fails;

- Analysing the measures foreseen in the CSDR to address settlement fails;

- Promote the dialogue and sharing of relevant information on the subject, with the Market;

- To provide its Participants with the essential functionalities for the entry into force of this new regime in February 1, 2022.

Documentation

- Official texts

Regulation of the European Parliament and of the Council, of 23 July 2014, on improving securities settlement in the EU and on Central Securities Depositories (CSDs). Published in the Official Journal (OJ) of the European Commission (EC) on August 28, 2014.

CSDR Level 1 entered into force in September 17, 2014.

The RTS and ITS, which correspond to Level 2 of the Regulation, are developed by the European Securities and Markets Authority (ESMA) and the European Banking Authority (EBA).

Regulation available at (link).

Regulation of 25 May 2018 with regard to regulatory technical standards on settlement discipline.

It is part of the RTS on Discipline of Settlement, submitted to the EC on February 2, 2016, adopted on May 25, 2018 and published in the OJ on September 13, 2018. They enter into force 24 months after publication in the OJ.

Regulation available at (link).

- External documentation

Document (draft) prepared by the ECSDA (European Central Securities Depositories Association) with the aim of harmonisation of rules and procedures related to cash penalties.

Latest version of the document is available at (link).

- INTERBOLSA documentation

Settlement Discipline – Briefing Paper

Settlement Discipline – Operational Manual

STD Layouts_Penalties

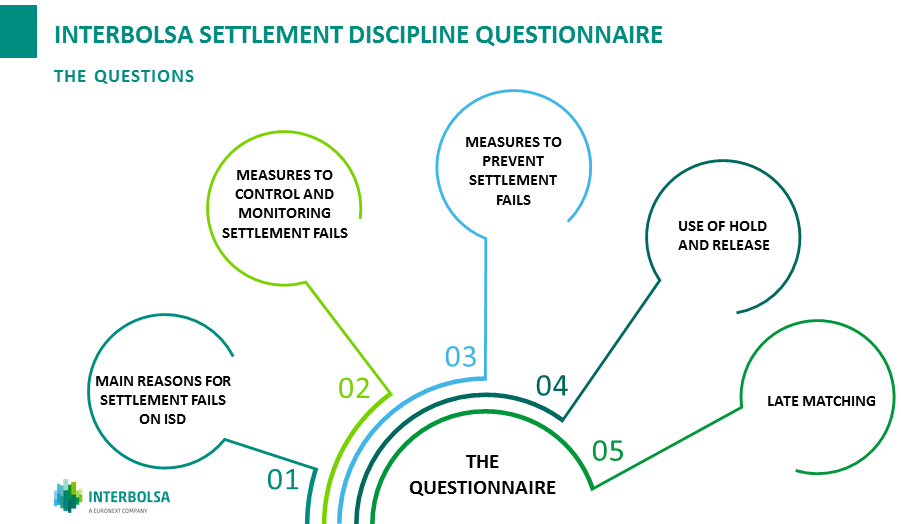

Questionnaire conducted by INTERBOLSA on June 7, 2019, with the aim to evaluate the difficulties faced by INTERBOLSA Participants regarding the settlement of transactions on intended settlement date (ISD) and to provide INTERBOLSA with the necessary information to continue analysing and implementing measures to prevent and address settlement fails.

Questionnaire available at (link)

- The answers to the Questionnaire:

| 1. Main reasons for settlement fails on ISD | SECURITIES: • Interconnected instructions • Long custody chain • Delay in the input of counterparty instruction • Late reception of SI | CASH: • Cash shortfall or collateral available • Delayed / wrong instructions • Technical issues |

| 2. Measures to control and monitoring settlement fails | SECURITIES: • Real time and daily monitoring of the SI and settlement fails • Daily reconciliation / internal checks and analysis • Proactive contact and report to clients / counterparties | CASH: • Real time and daily monitoring of cash balances • Daily reconciliation / internal checks and analysis • Proactive contact and report to clients / counterparties |

| 3. Measures to prevent settlement fails | SECURITIES: • Pre-match of SI • Prior validation of the positions and daily reconciliation • Proactive contact with clients / counterparties • Real time and intra-day reporting to clients • Prohibit short selling • Partial settlement | CASH: • Daily reconciliation and monitoring of liquidity levels • Liquidity planning / financial forecasts • Credit lines • Proactive contact with clients / counterparties and reports |

| 4. Use of Hold and Release | • Interconnected instructions (missing, unmatched or failing) • Delivery SI • Mostly used before ISD • Upon customer request • T2S auto-collateralization |

| 5. Late Matching | • Client instruction received after the settlement date • Changes to SI previously agreed or instructed • Lack of securities in a previous trade • Split of SI |

| Difficulties in the current settlement regime that can lead to settlement fails | • Use of Hold functionality • Lack of knowledge of the Portuguese Market by the international counterparties • Interconnected instructions in long chains • Absence of partial release functionality • SI Complexity (mismatch of SI) • Lack of information by the Clients |

Public Disclosure on Settlement Fails

Legal Entity Identifier: 529900LG70TCAGWCXT47

CSD: Interbolsa – Euronext Securities Porto

Measures to Improve Settlement Efficiency:

- Implementation of all the measures identified in the CSDR to prevent settlement fails

- Follow up of the daily fails

- Periodical meetings with the participants to analyse the main reasons for the settlement fails and identify the measures to be implemented

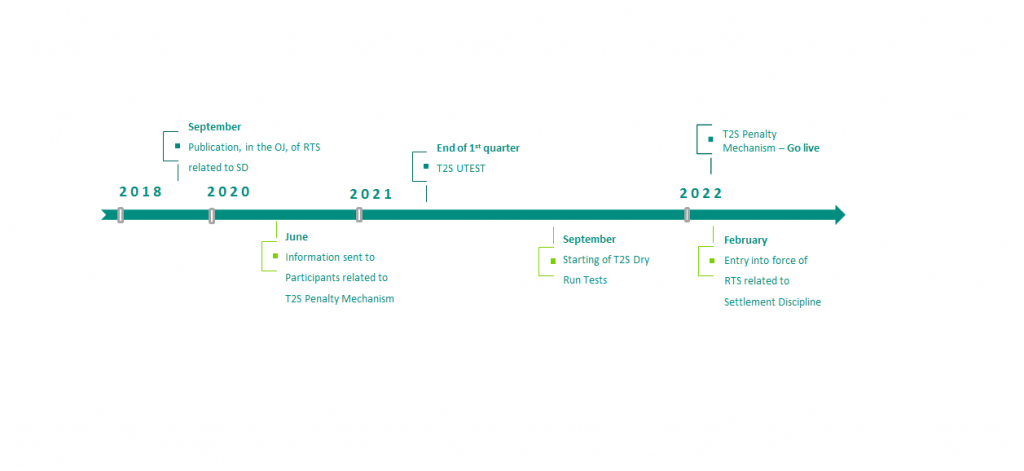

Timeline